option greeks pdf

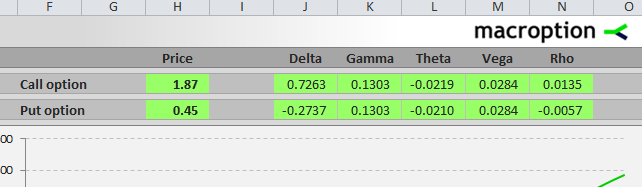

Aug 65 ITM Call Aug 75 ATM Call. It is defined as the rate of change of the option price with respect to the price of the underlying asset.

Trading Option Greeks How Time Volatility And Other Pricing Factors Drive Profit Wiley

Trading Option Greeks 326 Choosing between Strategies 326 Managing Trades 329 The HAPI.

. Delta Gamma Theta Delta - The change in the options value for every one unit change in the underlying 000-100 Gamma - The change in the options delta for every one unit change in the underlying gamma manufactures delta. Option Greeks For Traders written by Simon Gleadall and has been published by this book supported file pdf txt epub kindle and other format this book has been release on 2014 with categories. Vega ν is an option Greek that measures the sensitivity of an option price relative to the volatility of the underlying asset.

The delta varies between 0 and 1 for a call option and -1 to 0 for a put option. Foreword The past several years have brought about a resurgence in market volatility and options volume unlike anything that has been seen since the close of the twentieth century. Download View Dan Passarelli - Trading Option Greekspdf as PDF for free.

N x. It can be used to tell you how much your option contracts. Sign up for a globally recognised degree before 13th June 2022.

ν c ν p c σ SeqTN0d 1 T 331 3 VEGA 10. Save up to 80 off tuition. A top options trader details a practical approach for pricing and trading options in any market condition The options market is always changing and in order to keep up with it you need the greeksdelta gamma theta vega and rhowhich are the best techniques for valuing options and executing trades.

Apply now Simply choose from one of our 47 innovative career-focused Bachelor Master and MBA degrees. Greeks A Greek RISK MEASURE should not be thought of as a single number Rather a range of numbers to be examined in dierent buckets and Under dierent scenarios Saturday August 14 2010. However gamma decreases when an option is deep-in-the-money or out-the-money.

An option has a maximum gamma when it is at-the-money option strike price equals the price of the underlying asset. Download DAN PASSARELLI - TRADING OPTION GREEKS PDF for. Check Pages 1-50 of DAN PASSARELLI - TRADING OPTION GREEKS in the flip PDF version.

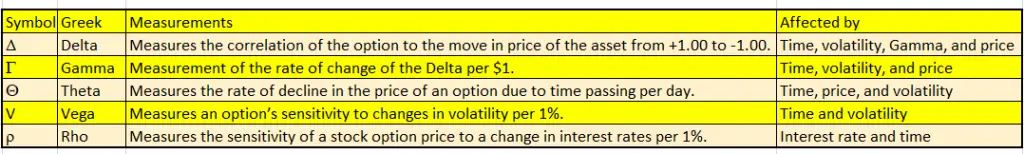

Option Greeks what are they. For more about option Greeks check out my article- Option Greeks Explained. The different Greeks are.

It is the slope of the curve that relates the option price to the underlying asset. DAN PASSARELLI - TRADING OPTION GREEKS was published by MyDocSHELVES DIGITAL DOCUMENT SYSTEM on 2017-10-23. The Greeks can be incredibly useful in helping you forecast what will happen to the price of options in the future because they effectively measure the sensitivity of a price in relation to some of the factors that can affect that price.

You can apply in 5 minutes and start your path to career success. Vega 33Formula The callPut option Vega will be. Strategy on the basis of mathematical formulations the u2 article also explains quantitatively the role of option 1 x Greeks in this strategy.

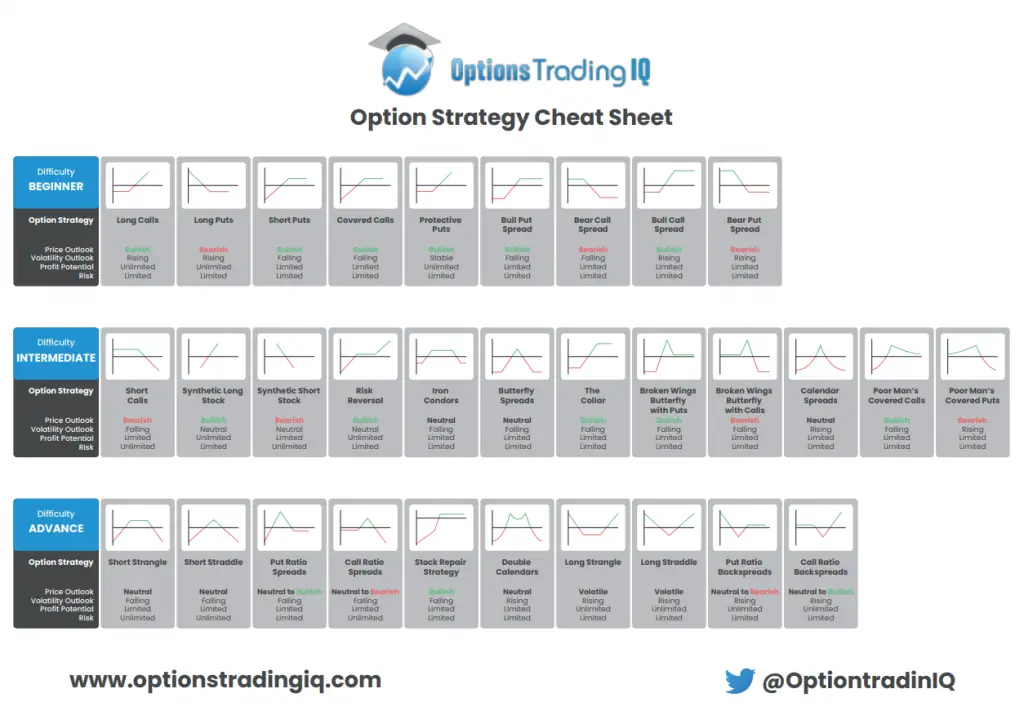

Here is an Option Greeks cheat sheet you can use as a quick reference guide. Find more similar flip PDFs like DAN PASSARELLI - TRADING OPTION GREEKS. Understanding the option Greeks is the key.

First order greeks in Python The Smile of Thales 3Vega 31Definition Vega is the options sensitivity to small changes in the underlying volatility. Assume that the dividend yield and interest rate are known. There are 3 common ways traders may use Delta in options trading.

It also shows that because of the put-call parity the Greeks of put and call. Option Greeks only affect extrinsic value time value of an option. A Detailed Graphical Treatment Singapore Management University QF 301 Saurabh Singal Saturday August 14 2010.

Aug 85 OTM Call Active Trader Pro For Illustrative Purposes Only Greeks. The measure of the sensitivity of an options price to different factors ¾Delta ¾Gamma ¾Theta ¾Vega ¾Rho. Hedging option exposure against the underlying asset Assume that you are long 1 call option on XYZ with strike K maturity T.

If you are interested in a deeper dive into options trading my Options 101. Specifically those factors are the price of the underlying security time decay interest rates and. Trading Options Greeks PDF Free Download Maximise your career growth.

Delta Δ C S Delta is the first. -- compute the implied volatility The exposure to the underlying asset is represented by the first derivative with respect to price V 2 1 2 2 2 S o t S C t t C S S C C C BSCall S. Besides explaining the mathematics behind volatility trading and the various features of this trading d 20t d10t σ T t.

Delta Gamma Theta Vega and Rho. Download or Read Online Trading Options Greeks in PDF Epub and Kindle. The Hope and Pray Index 329 Adjusting 330 About the Author 333 Index 335 xii Contents.

For those not familiar with option pricing it can also be an educational guide as well. Delta Delta Delta How it can help ya help ya help ya. This paper has proposed new option Greeks and new upper and lower bounds for European and American options.

Pdf Trading Option Greeks Download Book Online

Option Strategies Cheat Sheet New Trader U

Option Greeks Strategies Backtesting In Python By Anjana Gupta

Option Greeks Excel Formulas Macroption

Option Greeks Made Easy Delta Gamma Theta Vega Ep 199 Tradersfly

Download Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits By Dan Passarelli Online New Chapters Twitter

Dan Passarelli Trading Option Greeks Pdf

Option Strategy Cheat Sheet Pdf Greeks Finance Financial Economics

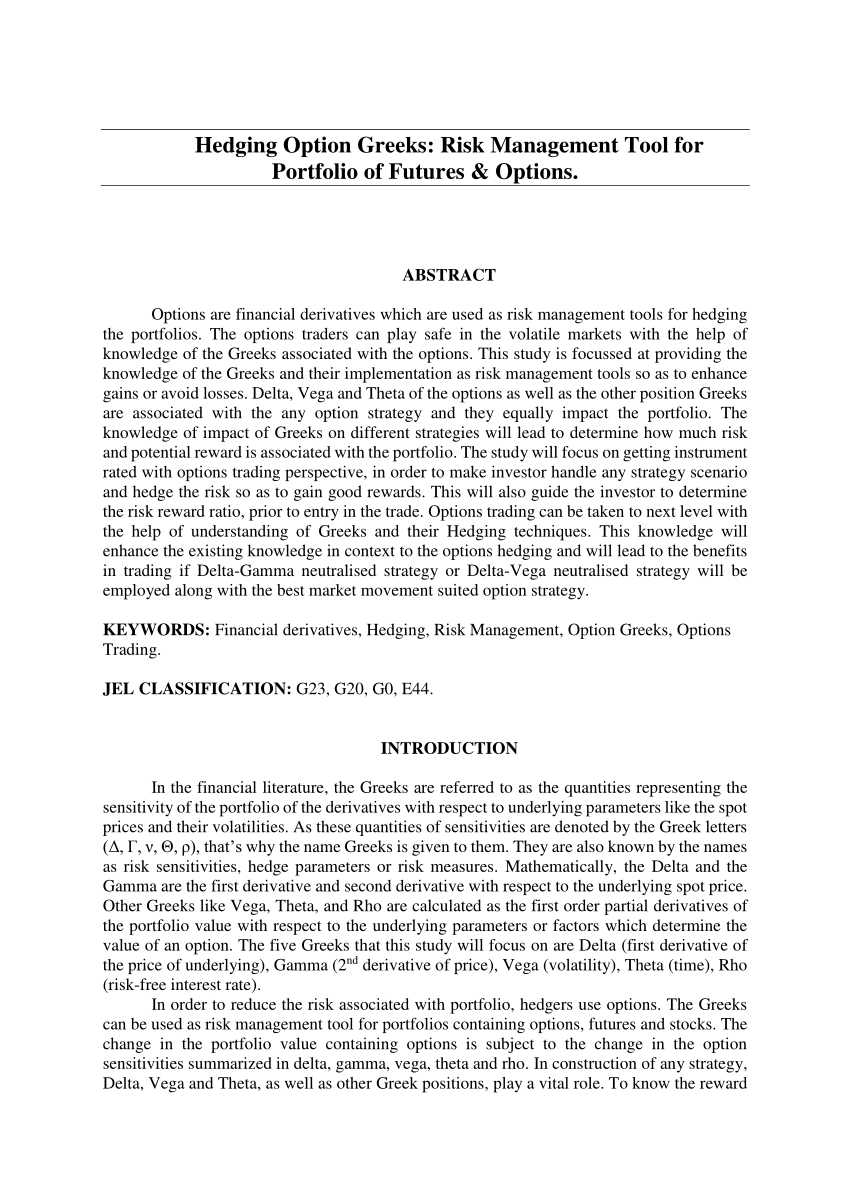

Pdf Hedging Option Greeks Risk Management Tool For Portfolio Of Futures And Option

Dan Passarelli Trading Option Greeks Pages 1 50 Flip Pdf Download Fliphtml5

Trading Option Greeks By Dan Passarelli Pdf Download Read

Pdf On Volatility Trading Option Greeks Publishing India Group Academia Edu

Options Pricing Option Greeks Explained Trade Options With Me

Read Pdf Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits Bloomberg Financial Book 159 R A R

Option Greeks February 8 2016 By Thomas Mann All Things Stocks Medium

Trading Options Greeks How Time Volatility And Other Pricing Factors Drive Profits 2nd Edition Wiley

Pdf Trading Options Greeks By Dan Passarelli Ebook Perlego

Option Greeks Cheat Sheet New Trader U

0 Response to "option greeks pdf"

Post a Comment